The Past, Present, and Future of Options Trading

Options trading is a critical aspect of the financial markets today, enabling investors to speculate, hedge, and manage risk in an efficient manner. While options are now considered sophisticated instruments, their origins date back hundreds of years, long before the advent of modern financial exchanges. As financial markets continue to evolve, so does the use of options—especially in the rapidly growing cryptocurrency market. This article will trace the history of options trading, examining its evolution from ancient Greece to modern-day, and explore how crypto options are shaping the future of trading.

The Origins of Options Trading

Early Use of Options in Ancient Greece

The concept of options dates as far back as ancient Greece, where early traders began using basic options contracts to hedge risks. One of the earliest recorded uses of options involved the Greek philosopher Thales of Miletus, who used options on olive presses. Thales predicted a bountiful olive harvest and secured the right to use olive presses at a predetermined price, allowing him to profit when demand surged.

These early options were referred to as "halters" and were used primarily for commodities like olive oil and wine. The use of these primitive contracts demonstrated the basic principles of options trading: securing future prices to hedge against risk or capitalize on speculative opportunities. This marked the beginning of using options to manage uncertainty in trade, a practice that would evolve over the centuries into modern-day options markets.

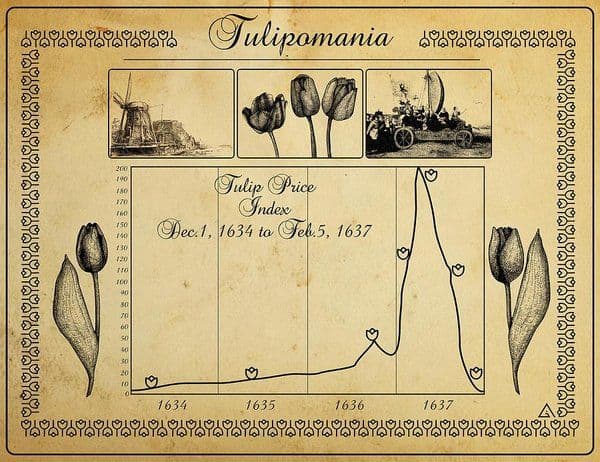

Tulip Mania and the Evolution of Options

Perhaps the most notorious historical episode involving options was the Tulip Mania of the 17th century in the Netherlands. In the early 1600s, tulips became an extremely valuable commodity, and a market for tulip bulbs emerged. To hedge against price fluctuations, tulip wholesalers and growers began using call and put options.

While the early use of options in the tulip market appeared to be reasonable for managing risk, speculative mania soon gripped the market. Prices skyrocketed, and ordinary citizens began speculating on tulip options, often risking their life savings. However, when the Dutch economy entered a recession in 1638, the bubble burst, and tulip prices collapsed. Many investors were left unable to fulfill their obligations, and since the market was unregulated, it resulted in massive financial losses.

Despite this speculative disaster, the tulip mania is a crucial part of options trading history. It revealed the dual nature of options: they can be powerful tools for hedging and speculation but can also lead to catastrophic outcomes when misused.

The Rise of Organized Options Trading

Although options trading had existed in various forms for centuries, it wasn’t until the 20th century that organized options trading took shape. In 1973, the Chicago Board Options Exchange (CBOE) was established, creating the first regulated exchange for trading standardized options. This marked a significant milestone in financial history.

The CBOE revolutionized options trading by introducing standardized contracts with uniform terms regarding expiration dates, strike prices, and underlying assets. Additionally, the CBOE implemented a system of clearing options trades through the Options Clearing Corporation (OCC), which ensured that all parties fulfilled their obligations. This provided security and transparency, greatly enhancing the credibility of the options market.

Since the founding of the CBOE, options trading has expanded across asset classes, including equities, indices, commodities, and currencies. Today, options are essential for traders and investors seeking to hedge risk or speculate on market movements.

What Is an Options Contract?

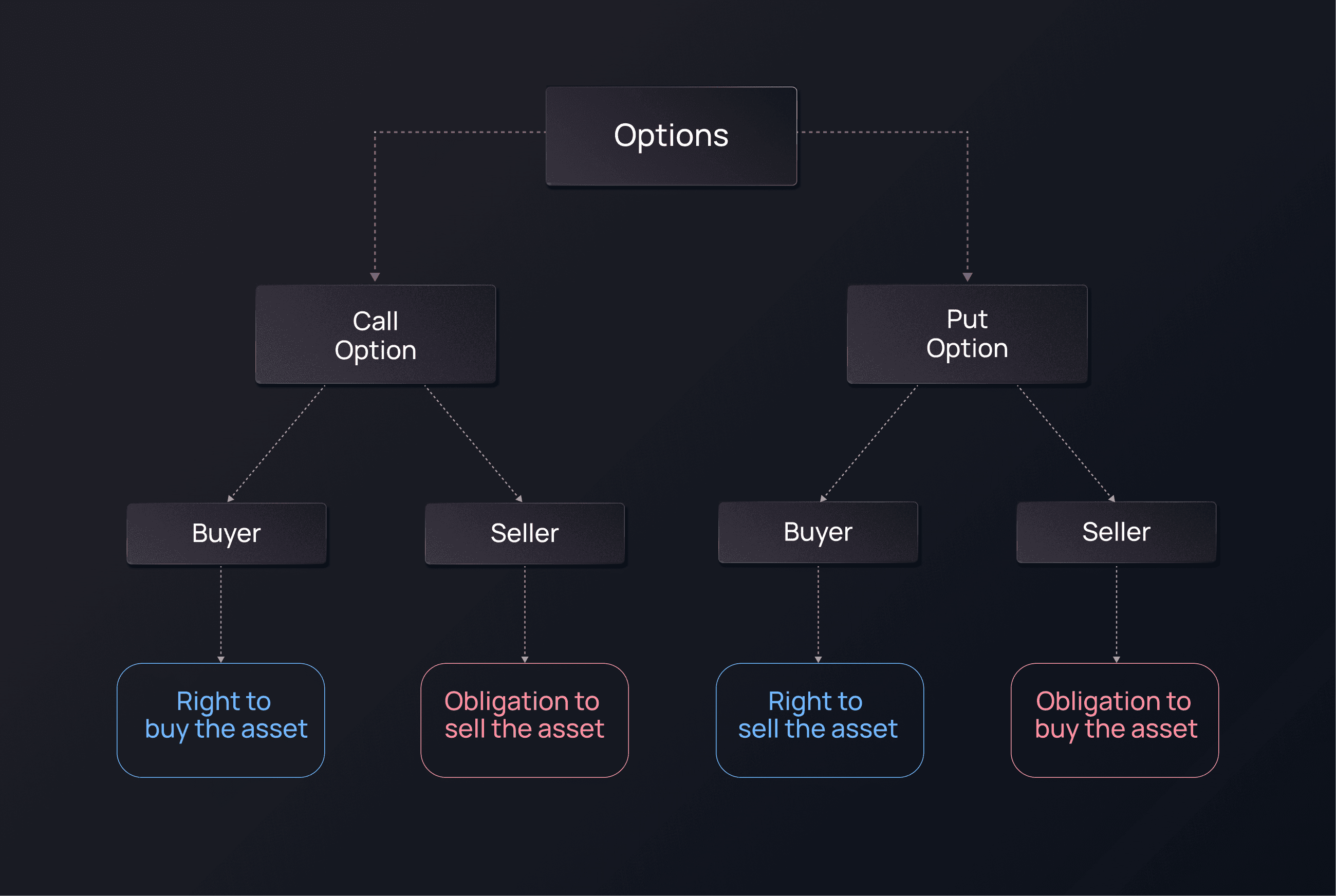

An options contract is a derivative financial instrument that grants the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before or on a specific date. Options allow traders to speculate on price movements without needing to own the underlying asset, making them a cost-effective way to control large positions in the market.

There are two primary types of options:

- Call options: Give the holder the right to buy an asset at a predetermined price (the strike price).

- Put options: Give the holder the right to sell an asset at a predetermined price.

For example, if you own a call option on a stock with a strike price of $50, and the stock's market price rises to $60, you can buy the stock at $50, earning a profit. Conversely, if you hold a put option on the same stock and its price drops to $40, you can sell it at the $50 strike price, again making a profit.

The Tulip Mania and Its Lessons

The Tulip Mania episode in 17th-century Holland offers an important cautionary tale about options trading. Tulip bulbs became incredibly valuable as a symbol of status, and to hedge against poor harvests, wholesalers and growers began using call and put options.

However, as the price of tulips soared, ordinary citizens began speculating on options, leading to an unsustainable bubble. When the Dutch economy entered a recession, tulip prices collapsed, and many investors who had sold put options found themselves unable to fulfill their obligations. This episode highlights both the potential and the dangers of options trading: while options can serve as effective tools for hedging risk, they can also fuel speculation and financial instability if misused.

The Modern Evolution of Options Trading

The Chicago Board Options Exchange (CBOE) and Standardization

The establishment of the Chicago Board Options Exchange (CBOE) in 1973 was a landmark moment in the history of options trading. It provided a centralized and regulated marketplace for options trading, offering standardized contracts and clearing services. The Options Clearing Corporation (OCC) played a pivotal role in ensuring that both parties in an options trade met their contractual obligations, bringing transparency and security to the market.

The CBOE's introduction of standardized options contracts helped options trading expand beyond commodities to include stocks, bonds, and indices, allowing for the creation of modern options strategies such as covered calls, straddles, and protective puts.

Technological Advancements and the Rise of Electronic Trading

In the 1980s and 1990s, technological advancements revolutionized the way options were traded. The rise of electronic trading platforms made it easier for traders to execute options trades efficiently and at lower costs. Automated systems also increased liquidity, allowing more participants to enter the market.

This period saw the introduction of new options-related products such as index options and exchange-traded options, further expanding the range of available options strategies. The accessibility of electronic platforms also helped to democratize options trading, enabling more retail investors to participate.

The Growth of Retail Participation in Options Trading

Historically, options trading was dominated by institutional investors and professional traders. However, in recent years, there has been a significant increase in the participation of retail investors in the options market. This growth can be attributed to several factors, including:

- The availability of online trading platforms that allow easy access to options markets.

- The rise of financial education resources, helping retail investors understand options strategies.

- Increased interest in hedging and speculation, especially during periods of high market volatility.

The participation of retail investors has had a profound impact on the options market, increasing trading volumes and liquidity. Many retail investors use options as a speculative tool, while others use them to hedge positions or generate income through strategies like selling covered calls.

The Future of Options Trading in the Crypto Market

The Emergence of Crypto Options

With the rapid growth of the cryptocurrency market, the demand for crypto options has surged. Crypto options are financial derivatives that enable traders to speculate on the future price movements of cryptocurrency assets like Bitcoin (BTC) or Ethereum (ETH). Similar to traditional options in stock or commodities markets, crypto options give traders the right, but not the obligation, to buy (call option) or sell (put option) a cryptocurrency at a set price (strike price) before a specific expiration date.

The appeal of crypto options lies in the high volatility of the cryptocurrency market. Traders can use options to hedge against price swings or speculate on the future movements of crypto assets. This has led to the creation of several platforms offering crypto options trading, including Deribit, Binance, and DOPP

Mechanism of Crypto Options

Crypto options operate through a contract between two parties: a buyer and a seller. The buyer of the contract pays a premium for the right to buy or sell the underlying cryptocurrency, while the seller assumes the obligation to fulfill the contract if the buyer exercises the option.

Key elements to understand in crypto options trading include:

- Strike price: The predetermined price at which the buyer can buy or sell the asset.

- Expiration date: The deadline by which the option must be exercised or it becomes worthless.

- Premium: The price paid by the buyer for the option contract..

How Crypto Options Differ from Traditional Options

While the core principles of options trading remain the same in both traditional and crypto markets, there are a few key differences:

- Volatility: Cryptocurrencies tend to be far more volatile than traditional assets like stocks or commodities. This increases both the risk and the potential reward for crypto options traders.

- Liquidity: Although liquidity in crypto options markets has grown, it remains lower than that of traditional options markets. This can lead to wider bid-ask spreads and less price stability.

- Regulation: The regulatory environment for crypto options is still evolving, and different jurisdictions have different rules regarding the trading of crypto derivatives.

The Benefits and Risks of Crypto Options

Benefits:

- Leverage: Like traditional options, crypto options allow traders to control large amounts of cryptocurrency with a relatively small initial investment.

- Hedging: Crypto options provide a way for traders to hedge their positions in highly volatile markets, reducing potential losses.

- Speculation: Crypto options can be used to profit from price movements without needing to own the underlying asset.

Risks:

- High Volatility: The extreme volatility of cryptocurrencies makes crypto options highly risky. While they can offer significant profits, they also expose traders to large potential losses.

- Regulatory Uncertainty: The evolving regulatory landscape for crypto options creates uncertainty for traders and platforms, particularly in jurisdictions where crypto derivatives are restricted.

- Liquidity Concerns: Some crypto options markets suffer from lower liquidity, which can make it difficult to enter or exit positions at desired prices.

The Future of Crypto Options

The future of crypto options looks promising, with growing interest from institutional and retail investors alike. As cryptocurrency adoption continues to expand, the demand for options trading will likely increase. Technological advancements in blockchain and decentralized finance (DeFi) are also expected to drive innovation in the crypto options space.

The rise of decentralized options platforms like DOPP could further democratize access to crypto options, allowing traders to execute options contracts directly on the blockchain without relying on centralized exchanges. This would enhance transparency, security, and privacy in options trading.

About DOPP: The Decentralized Crypto Options Platform

DOPP is an orderbook-based decentralized options and perpetuals trading protocol designed to fundamentally transform the landscape of derivatives trading & make access to complex crypto instruments easy and open for all. Built on its native ZK-rollup chain called DOPP chain, it not only facilitates the trading of options but also provides the foundational infrastructure for all who aim to build decentralized derivatives products and dApps. DOPP’s mission is to democratize access to complex financial products, making them available to a broader audience while maintaining the highest standards of security, simplicity, and transparency.

DOPP’s options and perps DEX is built on core values of innovation, community, transparency, and collaboration. DOPP is more than just a trading platform; it is a comprehensive ecosystem that addresses key issues such as capital inefficiency, lack of composability, and the centralization prevalent in traditional derivatives markets. By offering solutions like cross-collateralization, portfolio margin optimization, and multi-chain interoperability, DOPP enables a more inclusive, efficient, and interconnected financial landscape. Each element of DOPP’s ecosystem is designed to support and enhance the experience of retail and institutional traders, providing tools that are both powerful, secure, and easy to use.

Conclusion

From their origins in ancient Greece to the tulip mania of the 17th century and the establishment of the Chicago Board Options Exchange, options trading has evolved into a sophisticated tool used by traders and investors worldwide. Today, options trading is an integral part of the financial markets, providing opportunities for speculation, hedging, and income generation.

As the cryptocurrency market continues to grow, crypto options represent the next frontier in options trading. Despite the risks associated with high volatility and regulatory uncertainty, crypto options offer exciting new opportunities for traders looking to capitalize on price movements in digital assets.

As the world of finance continues to evolve, the future of options trading—whether in traditional markets or in the emerging world of cryptocurrencies—remains bright, offering traders and investors new ways to manage risk and pursue profit in increasingly complex markets.

← Return home